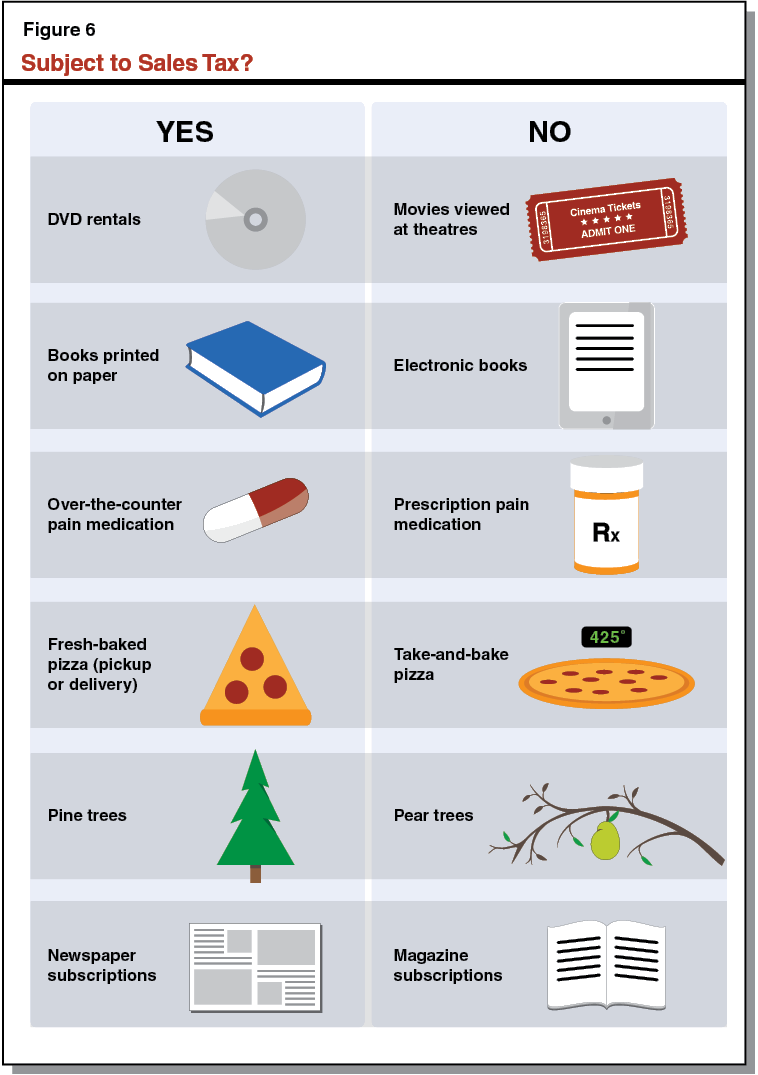

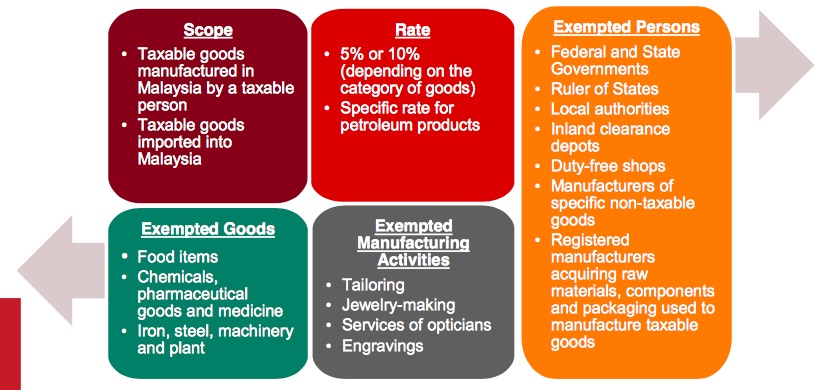

Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. Goods which are not exempted through Proposed Sales Tax Goods Exempted From Sales Tax Order will be charged sales tax at various rates 5 to 10 prescribed.

Malaysia Sst Sales And Service Tax A Complete Guide

Find out the right legislation and.

. Central GST Act 2017 CGST Central GST Rules 2017 CGST Settlement of funds Rules 2017. The use tax generally applies to the storage use or other consumption in California of goods purchased from. Power to grant exemption from tax.

Latest update on GST Bill implementation date 28-Feb-2017. State and Local Structure and Administration Washington DC Urban Institute Press 1994 2 nd ed 15. Amendment Made Effect of the amendment made.

Under the Goods and Services Tax registered dealers must file their GST returns with details regarding their purchases sales input tax credit and output GST. The main indirect tax of Mexico is the Value Added Tax locally known as IVA which generally applies to all imports supplies of goods and the provision of services by a taxable person unless specifically exempted by a particular law. Section Rule No.

Toll Free 1800 309 8859 91 80 25638240. Property on which sales tax paid. Latest news on GST 30-Mar-2017.

A GST Returns is a document that contains information about the income that a taxpayer must file with the authorities. Case Laws - All States. Latest update on GST.

MSTC Data Centre shall be relocated from its present location to New Town Kolkata during the period from 6th August 2021 to 8th August 2021. Companies Manufacturer or Sub-contractor with a sales value of taxable goods exceeded RM500000 for 12 months period are liable to be registered under the Sales Tax Act 2018. Pentad 2 to the sales tax office for approval.

GST Bill has been passed in Loksabha. CST Registration And Turnover Rules 1957. In addition to all other exemptions granted under this chapter there is hereby specifically exempted from the provisions of sections 144010 to 144525 and 144600 to 144761 and section 238235 and the local sales tax law as defined in section 32085 and from the computation of the tax levied assessed or payable under sections 144010 to.

There is also a list of unbranded food items that do not attract a cess collection. Due and Mikesell actually point out that for full economic efficiency the rate wouldnt be uniform but rather inelastically demanded goods would have a higher rate than those with elastic demands but it. The marketing arm or trading houses are required to apply for this exemption facility by submitting Form CJ.

The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent. Now the state assemblies would consider and pass their respective State GST SGST law. Sources also claim to raise the 5 slab to either 7 or 8 or.

At present tax on online sales is limited to imported goods that cost more than RM500. Latest update 06-Apr-2017. The government issued notifications on 05072022 thereby giving effect to the changes proposed by the GST Council in their 47th GST Council Meeting held on 28062022 29062022.

Due and John L. Different Sales Tax Rates Apply to Fuel. PM - Budget 2015 Speech Text more See More.

During this period only skeletal services shall be maintained and all major important activities including payment of global pre bid EMD and other online payments for auctions shall remain suspended. Poll Vote for GST Portal performances and view the poll result here. In this case the exemption provided under Item 91 allows the marketing arm or trading house to purchase goods exempted from sales tax from a licensed manufacturer.

Rajyasabha passes GST bill. The storage use or other consumption in this State of property the gross receipts from the sale of which are required to be included in the measure of the sales tax is exempted from the use tax. Essential goods have been exempted from the scheme.

We offer you a range of convenient payment options. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. According to this scheme luxury and expensive goods attract the most the highest tax.

Supplies in territorial waters. Place of supply of goods other than supply of goods imported into or exported from. In this article an attempt is made to understand the changes made.

The full form of CGST under GST law is Central Goods and Service Tax. NRS 372345 Use tax. DETERMINATION OF NATURE OF SUPPLY.

Central Sales Tax CST. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retailUse tax is imposed on the storage use or consumption of tangible personal property in this state. Central GST CGST.

VAT tax collected at every transaction for a. All States now agree to roll out GST by July 2017. Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels.

India Bangladesh English Bangladesh বল Middle East English Middle East عربي Africa Indonesia English Indonesia Bahasa. With local manufacturers currently subjected to a 5 to 10 sales tax finance minister Tengku Zafrul Aziz. PLACE OF SUPPLY OF GOODS OR SERVICES OR BOTH.

Check CGST meaning objectives features and taxonomy of CGST Law Act. INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. Central Sales Tax Act 1956.

The tax is imposed by the federal government of Mexico and ordinarily applies on each level of the commercialization chain. CGST - Effective Notifications. Toll Free 1800 309 8859 91 80 25638240.

The existing GST structure has 4 tiers with 5 12 18 and 28. This information used to compute the taxpayers tax liability. Proposed Goods Exempted From Sales Tax more Service Tax FAQ BM more Sales Tax FAQ BM more See More.

In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in.

Exempt Supply Under Gst Includes Nil Rated Taxable At 0 Non Taxable Supplies Persons Dealing Exclusively Goods And Services Chartered Accountant Supply

Understanding California S Sales Tax

Understanding California S Sales Tax

Tax Updates Union Budget 2021 Online Accounting Software Budgeting Cloud Accounting

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Purchase Of Exempted Goods Finance Dynamics 365 Microsoft Docs

Sales And Use Tax Regulations Article 3

Gst Exempt Supply List Of Goods And Services Exempted

Sales And Use Tax Regulations Article 3

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

10 Ways To Be Tax Exempt Howstuffworks

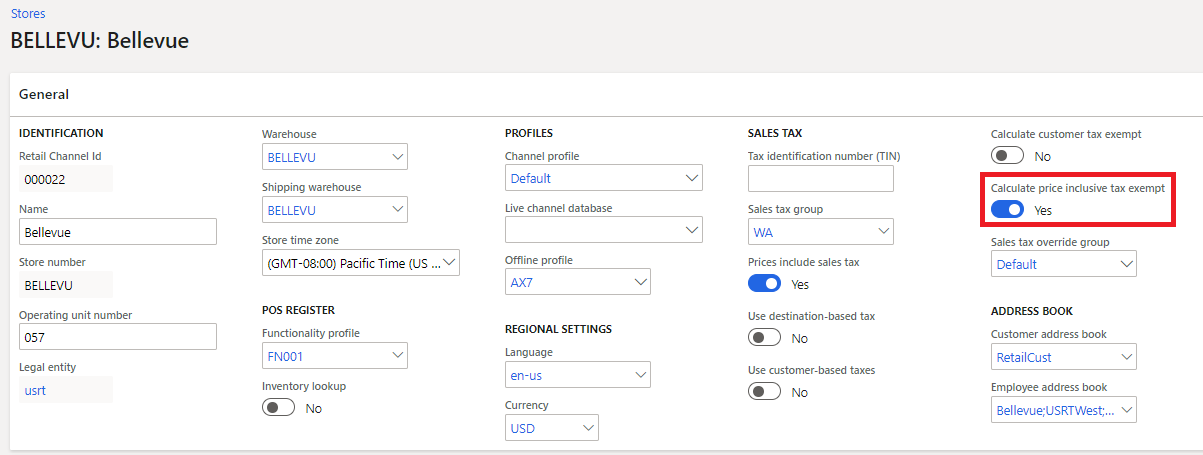

Calculation Of Tax Exemption Commerce Dynamics 365 Microsoft Docs

Sales And Use Tax Regulations Article 3

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

Sales Tax Exemption For Building Materials Used In State Construction Projects